What Does Commercial Property Insurance Policy Cover?

10/11/2022 (Permalink)

What Is Covered by a Commercial Property Insurance Policy?

Business property insurance can be confusing. What does it cover? What does it not cover? And if you do need to file a claim, how do you know when that's the case? Here's a quick guide to business property coverage, including what it covers and what kind of factors affect your premiums. We'll also show you how to determine whether you need additional coverage.

Replacement Cost vs. Actual Cash Value

Replacing the property is an important part of any commercial property insurance policy. The cost to rebuild the property will be covered by your policy if it's destroyed, but the amount of money you'll receive is dependent on your insurance company and the type of coverage you have.

One option is replacement cost coverage, which pays for rebuilding a destroyed building with new materials and equipment. This type of coverage may cost more than actual cash value (ACV), but it provides a higher level of protection should another disaster strike. ACV does not cover all repair costs due to depreciation or obsolescence; for example, if your office building was built in 2020 and later suffered damage that required removal of asbestos insulation before repairs could begin, ACV would not cover these costs because they're outside what would normally happen over time without being damaged.

Loss of Business Income

- Business Interruption Insurance: This type of coverage provides compensation for the loss of income you may incur when your business is damaged or destroyed.

- Business Income Coverage: This type of coverage provides compensation for lost profits due to business interruption, as well as expenses incurred while the property is being restored/repaired (known as extra expense), providing financial protection during this time.

- Loss of Use Coverage: This type of coverage offers financial protection if your business can't operate because it's no longer possible or practical to use it—for example, because it’s been damaged by fire or weather-related events like windstorms or tornadoes. You'll receive a cash payment based on the value of what you had before this happened, which may help replace some expensive equipment that was lost in the disaster but not covered under other parts of the policy

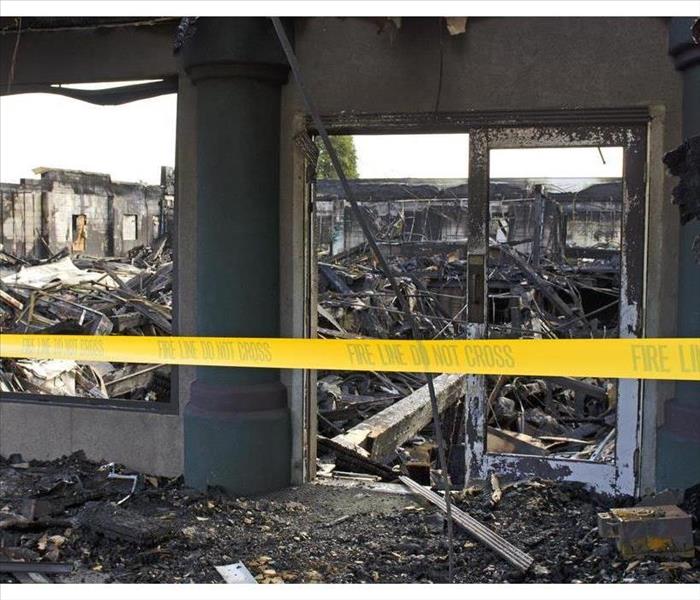

Property Damage

Property Damage Insurance covers damage to the building itself, not to its contents. Examples of property damage include:

- Fire, wind, and hailstorm damage

- Damage caused by or relating to water or other fluids that are not your own

- Earthquake damage (if you're in an earthquake zone)

Extra Expense

Extra expense insurance can be confusing because it's an "umbrella" term for three different types of coverage: business interruption, property damage and extra expense. But what do these terms mean?

Business interruption insurance pays you a preset amount each month (called the "loss of use allowance") if your building is damaged or destroyed by an insured event, so long as you continue paying your premiums and comply with all policy requirements. This benefit typically includes equipment rental costs while losses are being repaired or replaced; however, some policies exclude certain types of equipment or require additional deductibles before coverage kicks in.

Property damage protection helps pay for repairs after an insured incident causes physical damage to a structure such as fire or windstorm but doesn't include any eventual loss of use associated with it (e.g., rent payments).

Business Property Insurance is a Wise Investment

In today's business climate, it's more important than ever to protect yourself from unexpected losses. Business property insurance offers coverage for your property and assets in case of a fire or other disaster. You can also get coverage for liability, which ensures that you're covered if someone is injured on your premises or if one of your employees causes an accident offsite.

Business property insurance can help you save money on taxes by allowing you to deduct the cost of insuring your property against damage caused by natural disasters like hurricanes and tornadoes.

If you are looking into buying commercial real estate, it's important to ensure that the building is properly insured before signing any contracts with tenants or buyers. This way, if something happens to the building before closing (like getting flooded), then its value won't decrease significantly due to water damage alone.

Business property insurance is a wise investment. It can protect you against unexpected losses that may cost you time and money.

24/7 Emergency Service

24/7 Emergency Service